SALINA, KS – August 4, 2025

The City of Salina will hold a public hearing on the proposed 2026 budget on Monday, August 11 at 4:00 PM in Room 107 of the City/County Building, located at 300 West Ash Street.

This hearing is an opportunity for citizens to speak directly to the Salina City Commission and offer feedback on how public funds should be allocated before the budget is finalized. Public comment is encouraged.

2026 Proposed Budget Overview

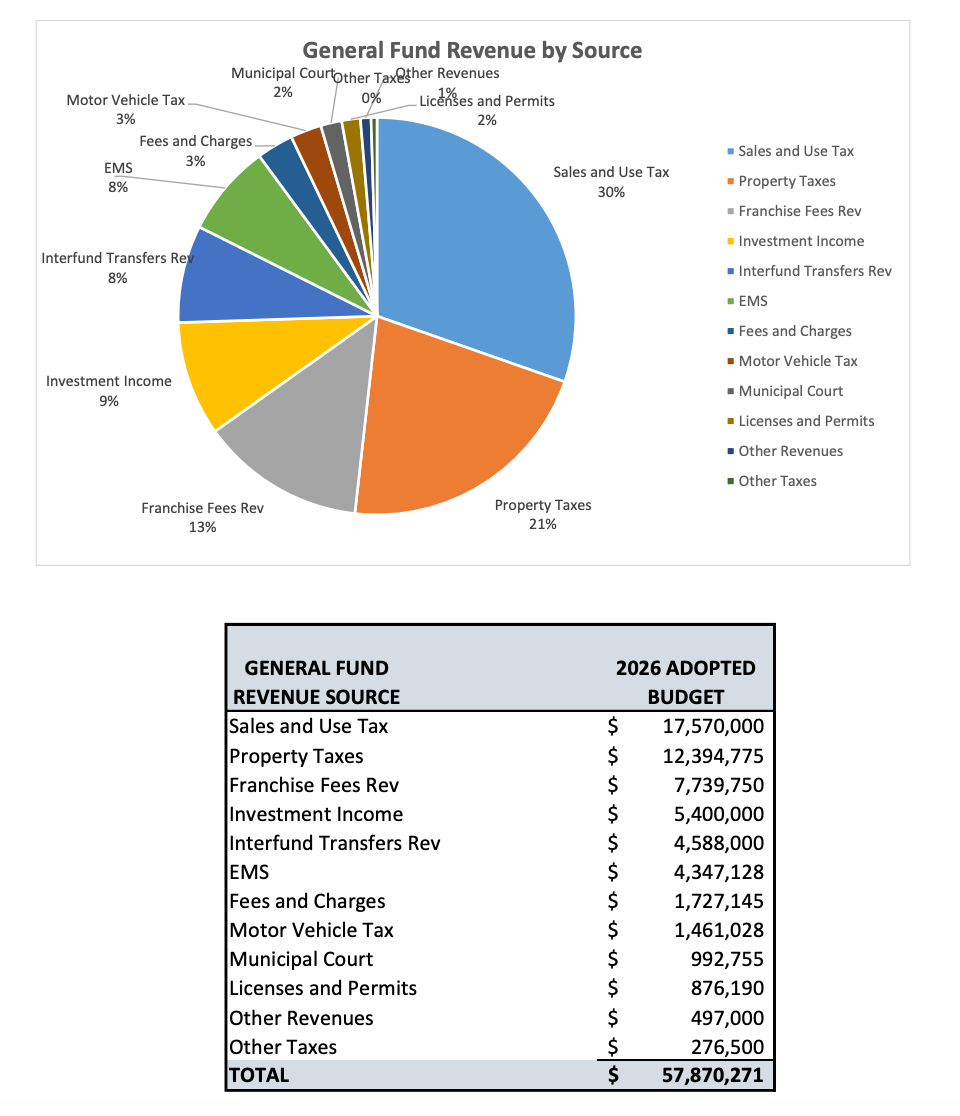

The proposed General Fund budget for 2026 totals $57,870,271, according to financial documents released by city staff. The General Fund is the city’s primary operating fund and supports services including police, fire, public works, parks, and general administration.

Top Projected Revenue Sources

- Sales and Use Tax: $17.57 million (30%)

- Property Taxes: $12.39 million (21%)

- Franchise Fees: $7.74 million (13%)

- Investment Income: $5.4 million (9%)

- Interfund Transfers: $4.59 million (8%)

- EMS Revenue: $4.35 million (8%)

Other funding sources include Fees and Charges ($1.73 million), Motor Vehicle Tax ($1.46 million), Municipal Court revenue ($993,000), Licenses and Permits ($876,000), Other Revenues ($497,000), and Other Taxes ($276,500).

Key Takeaways

- Sales and Use Tax remains the largest single source of revenue, making up nearly one-third of the proposed budget.

- Property Taxes continue to play a significant role in funding core services.

- The City emphasizes a diversified revenue approach to support essential operations.

Residents who want to review or comment on the proposed budget are encouraged to attend the hearing or contact city officials in advance. Final adoption will occur after the hearing process concludes.