This story was updated at 4:30 pm Wednesday with additional details:

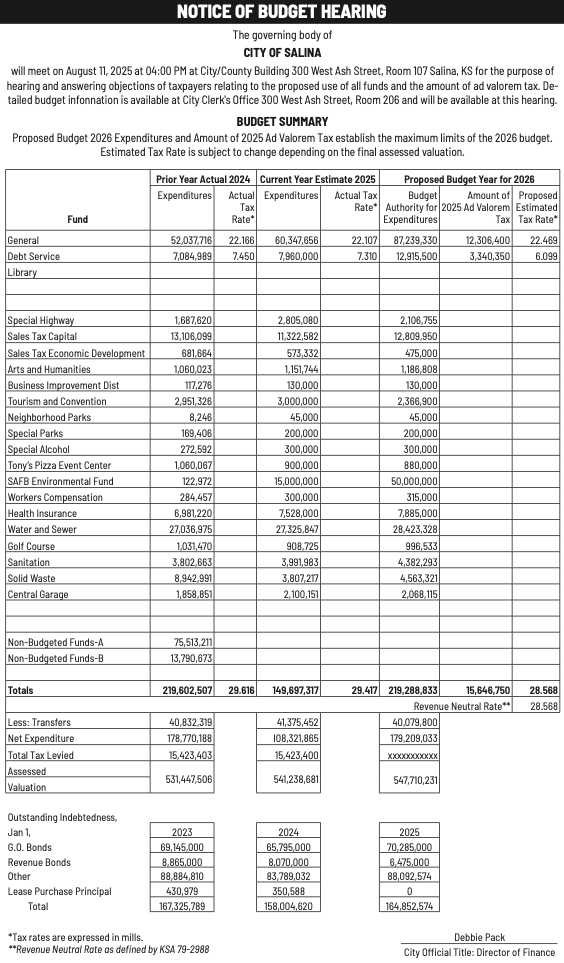

The City of Salina has released its proposed 2026 budget totaling $219.3 million in expenditures, representing a 46% increase from 2025's estimated spending of $149.7 million. The city will hold a public budget hearing on August 11, 2025, at 4:00 PM in Room 107 of the City/County Building to address taxpayer questions and concerns.

Tax Rate Decreases Despite Massive Budget Growth

Despite the substantial budget increase, Salina taxpayers will see a decrease in their overall tax rate from 29.417 mills in 2025 to 28.568 mills in 2026—a reduction of 0.849 mills. Importantly, the total amount of tax to be levied remains essentially the same at approximately $15.6 million for both years, with the rate decrease attributed to growth in the city's assessed valuation from $541.2 million to $547.7 million.

The revenue neutral rate has been calculated at 28.568 mills, meaning the proposed rate equals what would be needed to generate the same revenue as the previous year.

General Fund Sees Major Expansion

The most significant change from 2025 to 2026 appears in the General Fund, which is proposed to increase from $60.3 million to $87.2 million—a 45% jump. The General Fund supports core city services including police, fire, parks, public works, and general administration.

The General Fund tax rate will rise slightly from 22.107 mills in 2025 to 22.469 mills in 2026, an increase of 0.362 mills.

Debt Service Fund Changes

The Debt Service Fund is budgeted to increase significantly from $8.0 million in 2025 to $12.9 million in 2026—a 62% increase. Despite this growth in debt service obligations, taxpayers will see relief in this area, with the debt service tax rate dropping from 7.310 mills in 2025 to 6.099 mills in 2026—a decrease of 1.211 mills.

The city's total outstanding debt is projected to increase from $158.0 million in 2024 to $164.9 million in 2025, including $70.3 million in General Obligation Bonds, $6.5 million in Revenue Bonds, and $88.1 million in other debt.

Environmental Cleanup Dominates Capital Spending

Former Schilling Air Force Base Environmental Fund shows the most dramatic change from 2025 to 2026, jumping from $15 million to $50 million—a 233% increase. This fund, established in 2021 to track settlement funds for contamination cleanup at the former air base, represents the largest single budget item driving the overall increase. The cleanup effort is expected to span more than 30 years.

Other significant capital investments include:

- Sales Tax Capital Fund increased from $11.3 million in 2025 to $12.8 million in 2026

- Water and Wastewater operations budgeted at $28.4 million in 2026, up from $27.3 million in 2025

Departmental Budget Changes

Several city departments and services show noteworthy adjustments between 2025 and 2026:

Increases:

- Police Department grows from $12.4 million to $12.5 million

- Fire Department increases from $13.0 million to $13.6 million

- Parks & Recreation rises from $8.1 million to $8.4 million

- Public Works increases from $6.2 million to $6.5 million

- Solid Waste Fund increased from $3.8 million to $4.6 million (20% increase)

- Sanitation Fund grew from $4.0 million to $4.4 million (10% increase)

- Health Insurance Fund rose from $7.5 million to $7.9 million (5% increase)

Decreases:

- Tony's Pizza Event Center budget decreased from $900,000 to $880,000 (2% decrease)

- Tourism and Convention fund decreased from $3.0 million to $2.4 million (21% decrease)

- Sales Tax Economic Development declined from $573,332 to $475,000 (17% decrease)

Staffing Levels

The proposed budget includes funding for 520 full-time equivalent positions, up from 514 in 2025. This includes 508 full-time positions and 12 part-time positions across all city departments.

Revenue Sources

The city's revenue portfolio for 2026 includes:

- Sales and Use Taxes: $29.4 million (largest single revenue source)

- Property and Motor Vehicle Taxes: $16.2 million

- Franchise Fees and Other Taxes: $12.4 million

- Enterprise Fund revenues (utilities, sanitation, etc.): Over $33 million

Public Input Opportunity

City officials encourage residents to attend the August 11 budget hearing or review detailed budget information at the City Clerk's Office, located at 300 West Ash Street, Room 206. The hearing provides an opportunity for taxpayers to ask questions and raise objections regarding proposed spending and tax levels.

The proposed budget establishes maximum spending limits for 2026, though actual expenditures may be less than budgeted amounts. Final tax rates will depend on the certified assessed valuation.