In Monday's session, the City Commission deliberated Resolution No. 23-8173, endorsing the comprehensive 2024-2028 Capital Improvement Program. This program, dissected into the 5 Year Capital Improvement Program and the Sub-CIP, charts the course for significant projects and cash-supported initiatives.

The 5 Year Capital Improvement Program, renowned for its extensive projects with lengthy life cycles, takes center stage. These endeavors, often financed through debt, encompass six categories: CIP Planning, Building & Facilities, Parks, Streets, Vehicles & Equipment, and Water/Wastewater Enhancements. The Sub-CIP, a vital preapproval mechanism for cash-backed items, grants authority over the City Manager's purchasing limits.

Noteworthy is the meticulous groundwork laid in 2023, wherein all departments dedicated substantial effort to formulate a 10-year capital replacement plan. The outcome of this collective effort was unveiled during a July 3, 2023 Study Session before the City Commission.

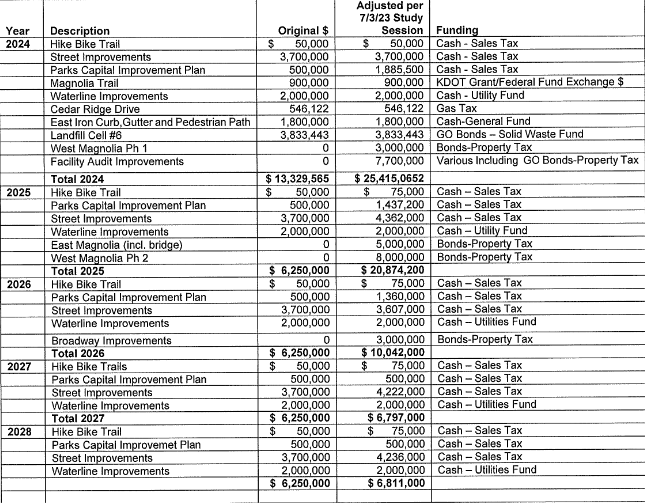

The proposed 2024-2028 CIP, currently under review, unveils the forthcoming five-year schedule of capital projects, anticipated funding sources, and a meticulous breakdown of projects not assigned to specific years pending further definition of scope or funding sources.

Having been presented during the July 3, 2023 Study Session, the proposed CIP has undergone a review by the Planning Commission on November 7, 2023. Resolution No. 23-2 from this body confirms the alignment of the proposed 2024 CIP projects with the goals and policies of the Comprehensive Plan.

Addressing long-term financial planning, the City, in consultation with the Commission, introduced a debt plan and a Sales Tax Capital Fund projection during the July 3, 2023, session. Staff recommends integrating additional projects into the 5 Year CIP, along with accommodating increases in annual allocations from the Sales Tax Capital Fund as previously sanctioned in the 2024 budget.

A comparative table highlights changes from the July 3, 2023, study session, emphasizing that annual allocations from the Sales Tax Capital Fund will be re-evaluated annually to ensure availability for increased allocations.

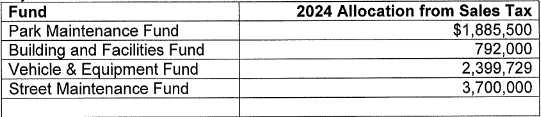

Turning attention to the 2024 Sub-CIP, the City Commission, during the annual budget process, approves spending levels for this fund. Staff then presents a detailed proposal of Sub-CIP expenditures, enabling bids on specific items upon approval. The allocations, rooted in long-term replacement plans and uncommitted sales tax funds, have been ratified by the City Commission.

The fiscal note underscores the financing mechanisms, indicating that while many CIP items will be funded within the annual budget, larger projects may necessitate temporary notes or bonds. The attached "2024-2028 CIP by Funding Source" table outlines anticipated funding sources for each project, with vigilant oversight to comply with legal and policy requirements.

All cash-funded projects exceeding the City Manager's purchasing authority, as well as any debt issuance, will be subject to City Commission approval before commitment or obligation. The motion to approve the Ordinance passed 5-0.