In Monday's City Commission Meeting, Resolution No. 23-8164 regarding the establishment of a special improvement district for water, sanitary sewer, street, and drainage improvements in Wheatland Valley Addition was discussed. The Commissioners deliberated on the advisability and authorization of this resolution, along with granting the City Manager the authority to execute an Improvement District Development Agreement between the City of Salina and Wheatland Development Co. Inc.

To provide context, Resolution No. 18-7556 outlines a two-step review process for special assessment financing. The developer initiated the first step by submitting an Application and signed Form of Petition on May 12, 2023, seeking approval for special assessment financing for public improvement installation. Following this, on September 18, 2023, the City Commission authorized staff to prepare the engineering feasibility report and resolution of advisability.

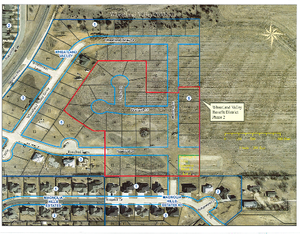

Collaborating with Mr. Daley and his engineer, city staff developed plans and cost estimates for the project. The public improvements within the benefit district encompass over 1,700 lineal feet of streets, 350 feet of storm sewer line, over 1,200 feet of water line, and more than 1,700 feet of sanitary sewer line.

The Wheatland Valley Addition is also set to undergo future enhancements to Markley Road, as per Resolution Number 19-7762. This resolution authorizes and deems advisable the construction of improvements, including curb, gutter, pavement, grading, and restoration for approximately 3,858 feet of Markley Road. The estimated cost of these improvements is $5,474,790.00, subject to quarterly adjustments based on the National Highway Construction Cost Index.

The Markley Road improvements will proceed when the average daily traffic number reaches 6,500 or as deemed appropriate by the governing body. Currently, the intersection of Magnolia and Markley records 3,665 vehicles over a 24-hour period.

City staff has collaborated with Wheatland Development Co., Inc. on a development agreement mirroring previous agreements for subdivision development. The developer will contract privately with contractors to carry out the improvements, and the City will reimburse eligible costs.

The City Commission, in accordance with Kansas statutes, reviewed a petition for street, drainage, sewer, and water improvements. Condition No. 3, requiring the petition to be signed by owners of record of more than half of the area liable to be assessed, was met. The Saline County Treasurer confirmed no delinquent special assessment taxes on the petitioners' properties.

The engineering feasibility report outlines the project scope, improvement district details, assessment methods, cost estimates, and properties in the benefit district. All costs, including construction, contingency, inspection, design, and bonding/interest, are proposed to be assessed to the benefit district.

Property owners may opt to pay their share as a lump sum or as a special assessment tax over 20 years, starting upon the issuance of General Obligation bonds by the City. The developer has provided financial guarantees equal to 20% of the project costs before any construction contracts or development agreements are approved.

The fiscal note indicates that 100% of the $1,589,224 estimated total cost of the improvements will be assessed to the Improvement District, with a per-lot assessment projected at $58,860.15. Property owners have the option to pay in full before the bond issue or spread the assessment and related interest costs over 20 years.

The motion was approved 4-0, with Mayor Hoppock recusing himself.