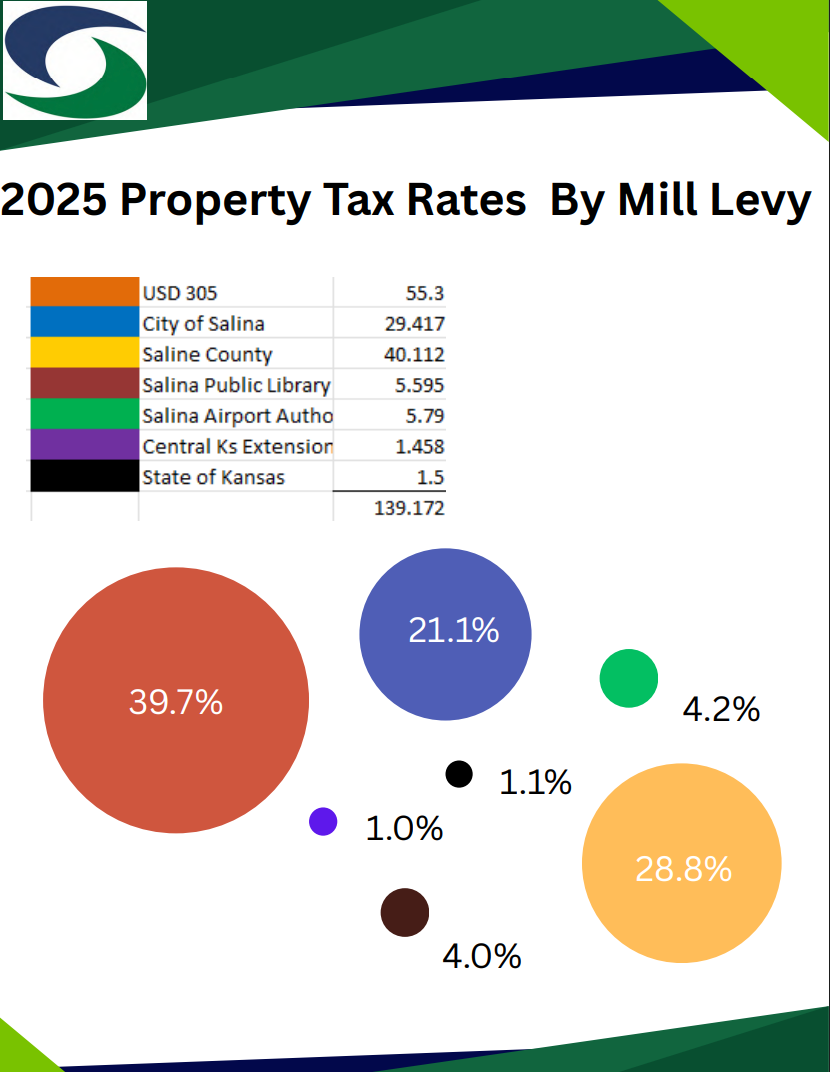

SALINA, Kan. — Property owners in Salina saw their 2025 tax bills reflect rates from several local and state entities, totaling a combined mill levy of 139.172. Each taxing body receives a portion of the total, which is applied to a property’s assessed value to determine the tax amount owed.

The breakdown is as follows:

- USD 305 – 55.3 mills (39.7% of total)

The largest share of the property tax rate goes to the Salina public school district, funding educational operations and capital needs. - Saline County – 40.112 mills (28.8% of total)

Supports county services including law enforcement, road maintenance, courts, and administrative functions. - City of Salina – 29.417 mills (21.1% of total)

Covers municipal services such as police, fire, parks, public works, and general administration. - Salina Airport Authority – 5.79 mills (4.2% of total)

Funds operations, maintenance, and development of the airport and industrial center. - Salina Public Library – 5.595 mills (4.0% of total)

Supports library operations, programming, and facility upkeep. - Central Kansas Extension District – 1.458 mills (1.0% of total)

Provides funding for agricultural, youth, and community education programs. - State of Kansas – 1.5 mills (1.1% of total)

Represents the state’s portion of the property tax, used for statewide purposes.

The mill levy rate determines how much property owners pay per $1,000 of assessed value. For example, a home with an assessed value of $100,000 would see an annual tax bill of roughly $1,391.72 before exemptions or adjustments.